Ray

M&A Consulting and Training

Ray

M&A Consulting and Training

Calling all small and medium enterprises (SME); be it family-run or professional-run.

Mergers & Acquisitions to achieve fast business growth

Mergers & Acquisitions to achieve fast business growth

Simplistic cross-functional AI-driven approach to decode the mysterious inorganic chemistry of business development.

Mergers & Acquisitions for Fast Business Growth

Strategic M&A Solutions

We provide end-to-end support for mergers, acquisitions, and business restructuring—empowering organizations to pursue strategic expansion with confidence. From opportunity identification and business valuation to due diligence, deal negotiation, and post-merger integration, our approach is grounded in deep industry knowledge, financial expertise, and a strong ethical foundation.

Whether you’re a startup laying the groundwork for strategic partnerships, an SME aiming to scale through acquisitions, or a large enterprise pursuing market consolidation, we provide the expertise and structured approach needed to navigate the complexities of inorganic growth.

Our Core Services

Empowering businesses to grow, transform, and lead through expert-driven strategic solutions. From mergers and valuation to financial planning and business model innovation, our services are designed to create measurable impact and long-term value.

M&A Consulting

The scope of consulting and advising is not limited to the following:

- Growth strategy through Mergers and Acquisitions

- Evaluating the right target businesses for acquisition

- Target-acquirer strategic fit evaluation

- Valuation of the Target and the acquirer, applying scientific, convincing, and justifiable methods

- Identification of sources of synergy from the proposed deal

- Perceived synergy valuation

- CIM (confidential information memorandum) preparation for the seller company

- Representation and Warranty (sell-side documentation)

- Purchase/Sale contract drafting

- Negotiation on behalf of the buy-side/sell-side

- Acquisition deal pricing based on target valuation, synergy valuation, and risk evaluation

- Payment for the deal

- Due diligence: financial, technical, legal, and HR

- Financial & non-financial system integration, including HR aspects

- Legal aspects of deal closing

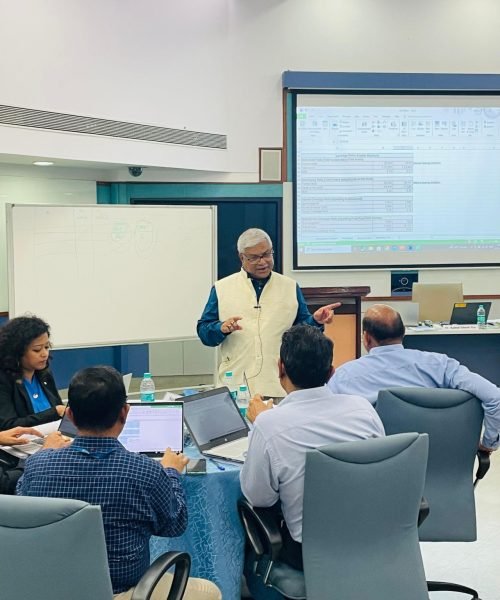

Training & Workshops

Empowering SME owners and teams with practical financial, strategic, and operational insights.

- Understanding Mergers and Acquisitions

- Business valuation

- Finance intervention for non-finance leaders

- Calibrating Business Models

- Working Capital Strategy

Featured Research & Publications

Focused research on mergers and acquisitions, backed by notable publications in reputed journals and a comprehensive book, offering deep insights into strategy, valuation, and integration.

Our research work centers around various dimensions of mergers and acquisitions (M&A), including strategy, valuation, integration, synergy modeling, SPACs, and hostile takeovers. The published work has appeared in globally recognized journals like Advances in Mergers and Acquisitions by Emerald Publishing (Scopus Indexed), as well as reputed business magazines like Indian Management.

Noteworthy contributions include the book “Mergers and Acquisitions: Strategy, Valuation and Integration” (2nd Edition, 2023, 904 pages), along with several peer-reviewed papers.

Ongoing research focuses on ESG factors in deal pricing and the accuracy of perpetual synergy measurement.

What My Clients Says

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

“Mr. Ray’s guidance during our acquisition phase was invaluable. His ability to simplify complex valuation methods helped us make confident, strategic decisions.”

— Rakesh Mehta

“I’ve followed Mr. Ray’s publications for years. His clarity of thought and deep understanding of M&A policy in India make his work stand out in the field.”

— Ritika Sinha

“As an academician, I found Mr. Ray’s research both profound and practical. His work has greatly influenced my own teaching on corporate restructuring.”

— Amit Verma

Stay In Touch

Stay updated with insights, publications, and news from Mr. Kamal Ghosh Ray. Subscribe for expert updates on M&A, strategy, and training sessions—right to your inbox.